SKYY – The Best First Trust Cloud Computing ETF

SKYY is the first trust cloud computing ETF that offers investors exposure to companies that are leaders in the cloud computing industry. The Skyy ETF is an excellent way for investors to gain exposure to the industry’s most promising companies without having to invest in individual stocks. Want to know more about SKYY? Please come with us!

What is the First Trust Cloud Computing ETF?

The First Trust Cloud Computing ETF is a publicly traded exchange-traded fund that allows investors to gain exposure to companies that are focused on cloud computing. Cloud computing is a technology that enables users to access data and applications over the internet, rather than from a local computer or server. The use of cloud computing has increased in recent years, as more businesses and individuals look for ways to access data and applications from anywhere in the world.

The First Trust Cloud Computing ETF, launched in 2011, seeks to track the performance of the ISE Cloud Computing Index, which is designed to reflect the performance of companies that are actively involved in the cloud computing industry. The ETF invests in a diversified portfolio of companies involved in various aspects of cloud computing, including software, hardware, and infrastructure.

What is SKYY?

SKYY is one of the First Trust Cloud Computing ETFs, and it is one of the most popular and widely held cloud computing ETFs. It tracks the performance of the ISE Cloud Computing Index, which is designed to provide exposure to companies involved in various aspects of cloud computing, such as software, platform, and infrastructure services.

There are several factors that make SKYY an attractive investment option for investors seeking exposure to the cloud computing industry. First, SKYY offers broad exposure to the industry, with holdings in a diversified range of companies. This diversification helps to reduce the risk of being overly exposed to any one company or segment of the industry.

Second, SKYY has a relatively low expense ratio of 0.60%, which makes it an attractive option for investors seeking low-cost exposure to the industry.

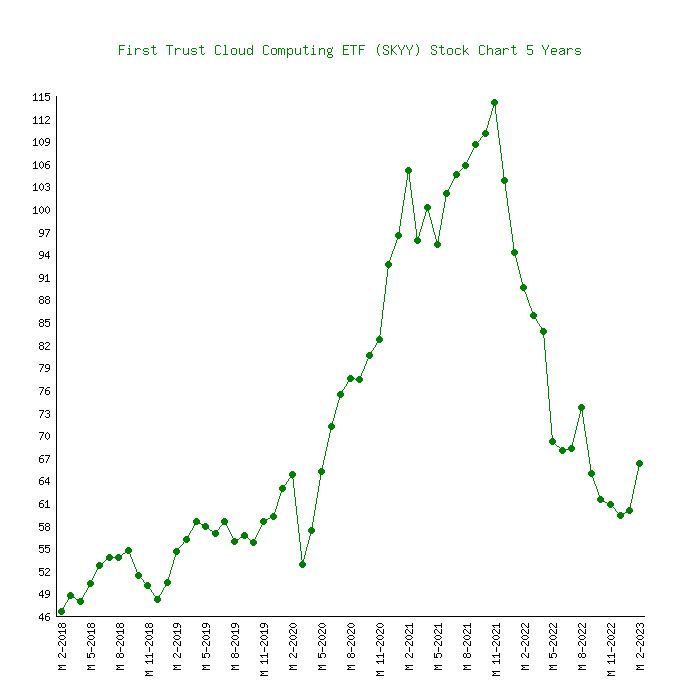

Finally, SKYY has a solid track record of performance, with a long-term average annual return of around 20%. Of course, past performance is not a guarantee of future results, but the ETF’s performance over the long term is a positive sign for investors.

While SKYY is one of the best-known First Trust Cloud Computing ETFs, it’s important to note that there are other ETFs in this category, each with their own investment strategy, holdings, and expense ratios. Investors should carefully consider their investment goals, risk tolerance, and individual circumstances before investing in any ETF.

What are the benefits of investing in SKYY?

Diversification: SKYY provides investors with exposure to a broad range of companies involved in various aspects of the cloud computing industry. This helps to reduce the risk of being overly exposed to any single company or segment of the industry, which can help to improve the risk-adjusted return of the investment.

Potential for Growth: The cloud computing industry is still in its early stages, and many analysts believe that it has significant growth potential over the coming years. By investing in SKYY, investors can potentially benefit from this growth potential as the industry continues to expand.

Low Cost: SKYY has a relatively low expense ratio of 0.60%, which makes it a cost-effective way to gain exposure to the cloud computing industry. Low expenses can help to improve the overall return on the investment over the long term.

Liquidity: SKYY is a highly liquid ETF, which means that investors can buy and sell shares easily and quickly. This can be an important consideration for investors who may need to access their funds quickly in the event of a financial emergency.

Accessibility: Investing in SKYY is accessible to a wide range of investors, as it can be purchased through a variety of brokerage platforms and investment accounts. This makes it an easy way for investors to gain exposure to the cloud computing industry without having to pick individual stocks.

What are the risks associated with investing in SKYY?

Market Risk: SKYY’s value will fluctuate based on the performance of the cloud computing industry and the companies within the ETF. If the industry experiences a downturn or if certain companies within the ETF underperform, the value of SKYY could decline.

Concentration Risk: SKYY is focused on a specific sector, the cloud computing industry. As a result, it is subject to concentration risk, meaning that changes in the performance of this sector will have a greater impact on the ETF than on a more diversified investment.

Liquidity Risk: While SKYY is highly liquid, there is always a risk that the ETF could become less liquid in the event of a market downturn or other adverse market conditions. In this scenario, it may be more difficult to buy or sell shares of the ETF at a favorable price.

Expense Ratio Risk: While SKYY’s expense ratio is relatively low compared to other actively managed funds, it is still an ongoing expense that will reduce an investor’s returns. If the expense ratio increases, it could negatively impact the ETF’s performance.

Currency Risk: Some of the companies in SKYY are based outside of the United States and may be subject to currency risk if the value of the U.S. dollar changes relative to other currencies. This could impact the performance of the ETF and may result in lower returns for investors.

Regulatory Risk: The cloud computing industry is subject to regulation and changes in regulation could negatively impact the ETF’s performance. For example, regulatory changes may require companies to increase their compliance costs or limit their ability to grow their business.

SKYY is the best First Trust Cloud Computing ETF because it has a strong selection of stocks that are good candidates for cloud computing. This ETF has a low expense ratio, making it an affordable way to invest in cloud computing stocks.

Conclusion: So above is the SKYY – The Best First Trust Cloud Computing ETF article. Hopefully with this article you can help you in life, always follow and read our good articles on the website: qule.info